Identify the two situations with the highest total surplus. – In economic analysis, identifying the situations with the highest total surplus is crucial for understanding market dynamics and maximizing welfare. This exploration delves into the factors contributing to these surplus situations and their implications for policy and economic growth.

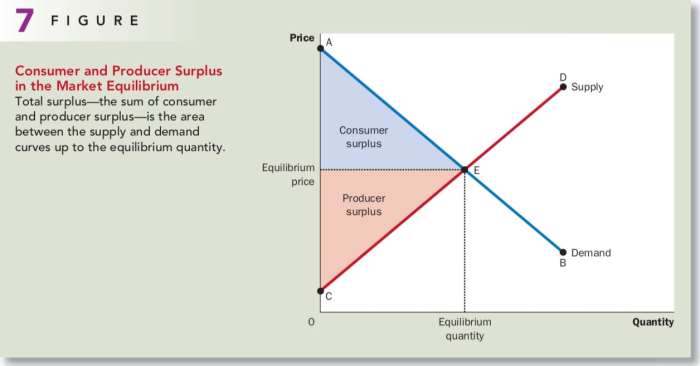

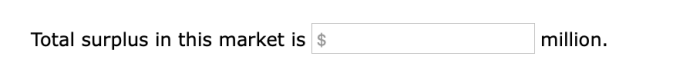

Total surplus measures the net benefit derived from an economic transaction, representing the combined gains of consumers and producers. Situations with high total surplus indicate efficient resource allocation and mutually beneficial outcomes.

Highest Total Surplus Situations: Identify The Two Situations With The Highest Total Surplus.

In a market, total surplus refers to the combined benefit received by consumers and producers. Two situations with the highest total surplus arise when:

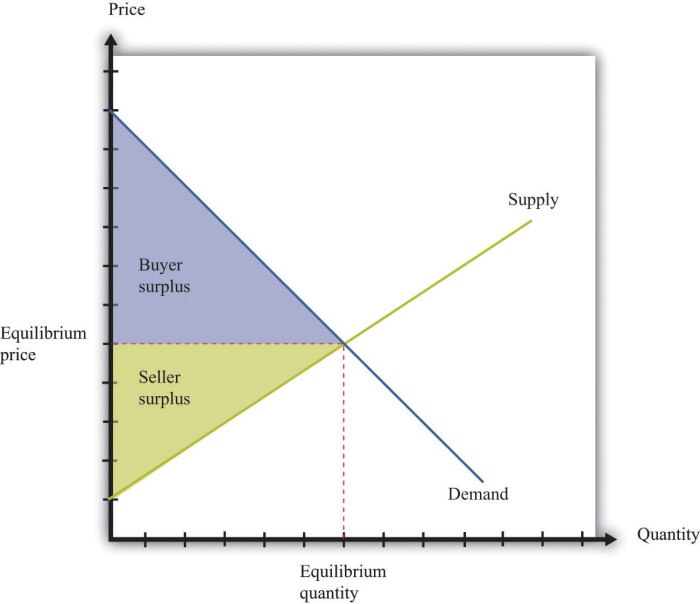

- Perfect competition:In a perfectly competitive market, there are numerous buyers and sellers, and no single entity has market power. This leads to a market equilibrium where the price equals the marginal cost, resulting in an efficient allocation of resources and maximum total surplus.

- Monopoly with price discrimination:A monopoly occurs when a single seller controls the entire market. However, if the monopolist can price discriminate by charging different prices to different consumer segments, it can increase its total surplus by capturing more consumer surplus while still maximizing its profit.

Comparison of Surplus Situations, Identify the two situations with the highest total surplus.

While both perfect competition and monopoly with price discrimination lead to high total surplus, they differ in their underlying mechanisms:

- Efficiency:Perfect competition ensures efficient resource allocation by equating price to marginal cost. Monopoly with price discrimination, while increasing total surplus, does not necessarily achieve efficiency due to its distortionary pricing.

- Distribution of surplus:In perfect competition, surplus is evenly distributed between consumers and producers. In monopoly with price discrimination, the monopolist captures a larger share of the surplus, potentially at the expense of consumer welfare.

Policy Implications

Understanding the factors contributing to high total surplus has implications for economic policy:

- Promoting competition:Encouraging perfect competition through antitrust laws and regulations can maximize total surplus and promote economic efficiency.

- Regulating monopolies:If a monopoly is unavoidable, regulating its pricing and behavior can prevent it from exploiting consumers and reducing total surplus.

- Taxation:Governments can use taxation to capture some of the surplus generated by monopolies, redistributing it to consumers or funding public services.

Limitations and Future Research

This analysis has limitations:

- Assumptions:The analysis assumes perfect information and rational behavior, which may not always hold in real-world markets.

- Dynamic effects:The analysis does not consider dynamic effects, such as innovation and technological change, which can impact total surplus over time.

Future research can explore:

- Empirical analysis:Investigating the empirical relationship between market structure and total surplus in real-world markets.

- Behavioral economics:Incorporating behavioral economics to understand how psychological factors influence consumer and producer behavior in surplus-generating situations.

Q&A

What are the key factors that contribute to high total surplus?

High total surplus typically arises from market conditions characterized by low barriers to entry, perfect competition, and balanced supply and demand.

How can policymakers leverage insights from high total surplus situations?

Policymakers can use these insights to design policies that encourage competition, reduce market distortions, and promote efficient resource allocation.

What are the limitations of analyzing situations with the highest total surplus?

Limitations include data availability, market complexities, and the potential for externalities that may not be fully captured in the analysis.