Macro topic 3.8 fiscal policy answers – Delving into the realm of fiscal policy, this comprehensive guide explores the intricacies of macro topic 3.8, providing insightful answers to complex economic questions. Fiscal policy, a powerful tool wielded by governments, holds the potential to shape economic activity, influence inflation, combat unemployment, and address inequality.

This discourse delves into the various fiscal policy tools, their advantages and disadvantages, and their applications in achieving specific economic objectives. It examines the impact of fiscal policy on economic growth, inflation, unemployment, and inequality, drawing upon real-world examples to illustrate its effectiveness.

1. Fiscal Policy Tools

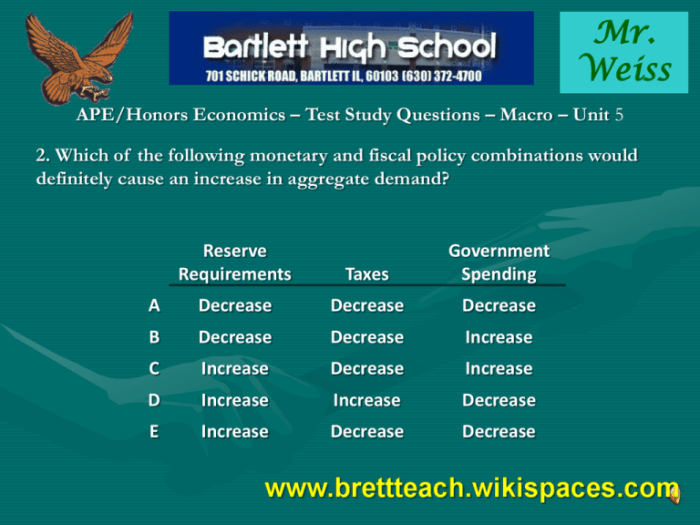

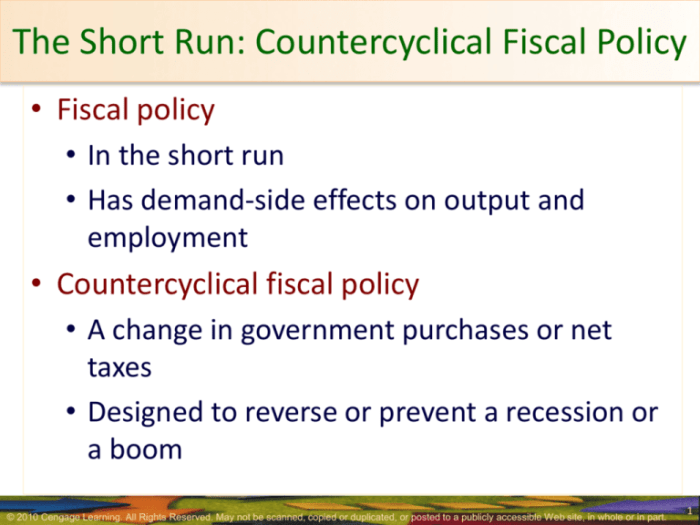

Fiscal policy refers to the use of government spending and taxation to influence economic activity. Governments can use a variety of fiscal policy tools to achieve their economic objectives, including:

- Government spending:Governments can increase or decrease their spending to stimulate or slow down economic activity. For example, increasing government spending on infrastructure projects can create jobs and boost economic growth.

- Taxation:Governments can raise or lower taxes to influence economic activity. For example, reducing taxes can increase disposable income and stimulate consumer spending, while raising taxes can reduce disposable income and slow down economic activity.

- Government borrowing:Governments can borrow money to finance their spending. This can be used to stimulate economic activity in the short term, but it can also lead to higher levels of government debt in the long term.

The choice of fiscal policy tools depends on the specific economic objectives of the government and the economic conditions at the time.

2. Fiscal Policy Objectives: Macro Topic 3.8 Fiscal Policy Answers

The primary objectives of fiscal policy are to:

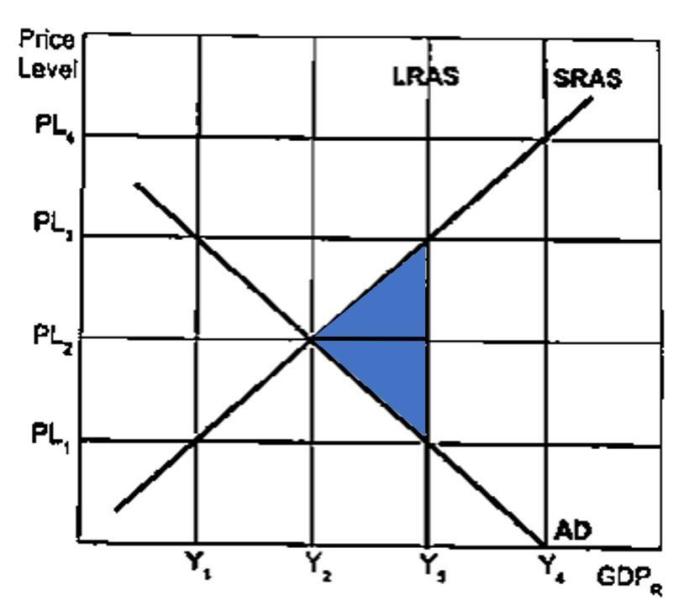

- Promote economic growth:Fiscal policy can be used to stimulate economic growth by increasing government spending or reducing taxes. This can lead to increased investment, job creation, and higher levels of output.

- Control inflation:Fiscal policy can be used to control inflation by reducing government spending or increasing taxes. This can reduce aggregate demand and slow down economic growth, which can help to bring inflation under control.

- Reduce unemployment:Fiscal policy can be used to reduce unemployment by increasing government spending or reducing taxes. This can lead to increased job creation and lower levels of unemployment.

- Reduce inequality:Fiscal policy can be used to reduce inequality by increasing taxes on the wealthy or providing tax breaks to the poor. This can help to redistribute income and reduce the gap between the rich and the poor.

The achievement of these objectives often involves trade-offs. For example, stimulating economic growth may lead to higher inflation, while reducing unemployment may lead to higher government debt.

FAQ

What is the primary objective of fiscal policy?

The primary objective of fiscal policy is to influence economic activity by adjusting government spending and taxation to achieve specific macroeconomic goals.

How can fiscal policy be used to promote economic growth?

Fiscal policy can be used to promote economic growth by increasing government spending or reducing taxes, which stimulates aggregate demand and boosts economic activity.

How can fiscal policy be used to control inflation?

Fiscal policy can be used to control inflation by reducing government spending or increasing taxes, which reduces aggregate demand and slows down economic activity.